1. Power market

1.1. Basics

1.2. Electricity as a market commodity

1.3. Capacity as a market commodity

1.4. Power trade schemes

1.5. Trade participants

1.5.1. Suppliers

1.5.2. Consumers

1.5.3. Others

Abstract

There is a noticeable lack of publications about the Russian Wholesale Electricity Market, both in English and Russian. In this paper, the author aims to outline the fundamental aspects of the Russian Wholesale Electricity Market for a wide audience. The first version of this paper was written in Russian and published in “Energo-Info” magazine and on the author's personal website www.mbureau.ru in November 2018. This second paper, the English version, has been adapted for foreign language readers.

The author wishes to express thanks to Professor A. P. Karpenko, for providing the idea for the paper, and her colleagues, Vera Filimonova, Jørund Haartveit and Gisle Tveit, for their support in this work.

The paper is dedicated to A.N. Eliseev.

Terminology

There are two terms in English to be applied when it comes to economy of power systems: electricity and power.

In terms of physics, power is the amount of energy in a tiny period — for example, a fraction of a second. Power is measured in Watts (W) and is often referred to as the rate of doing work. Meanwhile, electricity, to be precise electric power or electrical energy, is the amount of energy produced or consumed during a specific period — for example, one hour. In power systems, electricity is usually measured in Watt•Hours (Wh). Thus, electricity and power are entirely different issues.

From an economic point of view, these terms seem to be synonymous. Sometimes we come across the term power market and sometimes electricity market; the terms are interchangeable and this could confuse the reader. In this paper, the term electricity is used to be consistent with physics — electrical energy is to be traded. The only exception is made for the job of power analyst, as this is a generally accepted title. A further point of note is that, in this paper, supply is used to refer to power supply and consumption is used to refer to electricity consumption.

Finally, the term capacity defines the maximum power output a power plant can produce under specific conditions. This term is used consistently in papers on the subject and does not raise any issues with interchangeably.

Introduction

The first thing to note is that electricity trading is an unusual activity because electricity is a very peculiar commodity. In some ways, it can be thought of as a three-headed dragon. The power analyst who explores the electricity market and predicts its behaviour is the knight, challenging the three-headed dragon on a daily basis.

The first dragon head is named electricity. Why is electricity a very special commodity? Why do electricity markets function together with capacity markets? How is electricity trading organised? Who are the electricity market participants? The first head is the simplest one for reading and understanding.

The second dragon head is named trading. What stages are developed for wholesale electricity trading? What do trading activities look like? How are wholesale prices formed? The second head requires both patience and attention in order to fully understand it.

The third and final dragon head is named analysis. What is the electricity price analysis problem? What is the solution to the problem? This head is the toughest one. To understand it requires not only patience and attention, but additionally time and a willingness to go deep into details. Two examples of price analysis for the Wholesale Electricity Market of Russia are included at the very end of this paper.

Each section of this paper is dedicated to an individual dragon head. The second and third sections of this paper are written in a more formal and, consequently, less interesting style than the first one. As a result, the last two will be interesting to readers who are already familiar with electricity trading or to those who are willing to study the subject.

1. Power market

1.1. Basics

Electricity is one type of energy; it is obtained by converting primary resources (like coal, gas, solar radiation, etc.) to a conjunction of a current and a voltage in a network. The first technological revolution in electricity production happened in 1870–1910 [1], [2]. Currently, we are witnessing another technological revolution, related to producing electricity from solar radiation and the wind [3].

Electricity as a market commodity is a somewhat new idea if we leave aside the early electricity market experience in the USA between 1887 and 1893 with its harsh principals [1]. From the end of the 19th century until recently, the companies which produce, transmit and distribute electricity were considered to be a natural monopoly. Activities were controlled and regulated by the government. The development of electricity transmission lines led to division in this monopoly. The single entity was split into three parts regarding its activities:

- supplier, which produces electricity;

- network, which transmits electricity;

- distributor, which provides electricity to the end users.

Currently, two market types have been developed for electricity trading: wholesale and retail.

The first attempt to run an electricity market took place in Chile in 1981. During the 1990s a number of other countries, including Brazil, Peru, Columbia, and the United Kingdom, began trading electricity under market conditions. Nowadays, wholesale electricity markets operate in more than 30 countries all over the world. Improvements to trading rules are constantly being made [4].

A wholesale electricity market is only possible where there is a well-developed transmission network. A developed network allows suppliers to compete [1]. Network companies' activities are still, mainly, regulated by governments. Distribution companies buy electricity on the wholesale market and sell it on to the retail market. The public buys electricity from the distribution companies and is considered a participant in the retail market, together with other small consumers like offices, shops, gyms, etc. In 2017 approximately 93% of all the electricity produced in Russia was sold on the wholesale market *.

* 65 out of 85 regions of Russia are included in the Wholesale Electricity Market.

1.2. Electricity as a market commodity

Electricity as a market commodity is distinguished from other products by two main features which have been called demand-side flaws [1]:

- The lack of real-time metering and, as a result, uncertainty about the price of consumed electricity. In other words, we don't know the price while consuming electricity and can't regulate our consumption in relation to that price.

- The lack of real-time control of power flow and, as a result, practical inability to make the electricity flow go from a particular seller to a specific buyer. In other words, electricity logistics only relate to the laws of electrical engineering, not economic laws.

The main electricity market participants are the suppliers, who own power plants, produce and sell electricity, and the consumers — companies which buy and consume electricity.

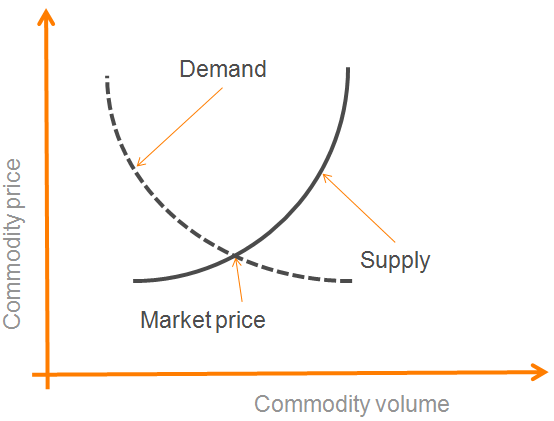

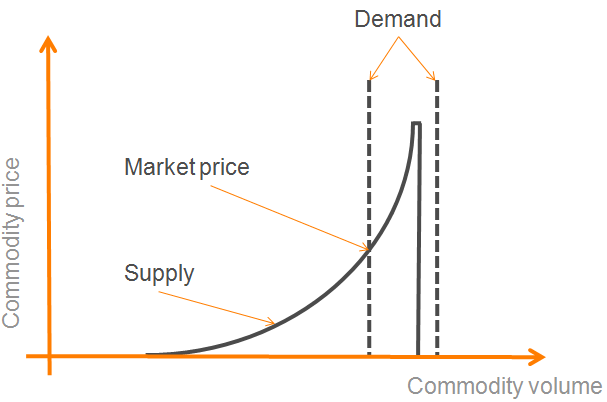

The first demand-side flaw leads to an inelastic demand for electricity on the market. Inelastic demand means that demand value doesn't depend on commodity price. There are elastic demand and supply curves for most products, as shown in figure 1a. The intersection of those two curves (demand and supply) creates the market price. In the case of elastic demand, the volume purchased by the consumer varies according to the price; if the price goes up, purchase volume will go down and vice versa. In the case of electricity, purchase volume regulation is not practically possible. In 2017 in Russia 99.5% of electricity demand was inelastic.

Electricity supply has an upper limit, which is determined by the total capacity of operating power plants. This combination of inelastic demand and limited supply could lead to cases when demand is higher than maximum supply (figure 1b), i.e. the power system requires more electricity than can be produced by all the available power plants at that time. The constancy of the electrical grid frequency, equal to 50 or 60 Hz, is ensured by momentary balance — a precise match between produced and consumed electricity. When demand exceeds supply, an imbalance between produced and consumed electricity occurs. This imbalance leads to a drop in frequency and voltage in the power network. In such situations, special measures are taken to maintain frequency and voltage levels, including consumers being cut off from the power network.

The second demand-side flaw complicates bilateral agreements. A bilateral agreement implies that a supplier will produce and deliver a specific volume of a product to a consumer. The consumer, in turn, pays for the product and delivery. Let's imagine supplier A, who wants to sell 1 MWh of electricity to consumer B tomorrow between the hours of 12 AM and 1 AM. According to the bilateral deal, supplier A produces 1 MWh of electricity at the appointed hour and delivers it to the network. In the same hour, consumer B receives 1 MWh of electricity from the same network. As far as the power flow obeys the laws of electrical engineering, there is no guarantee that the exact 1 MWh goes from supplier A to consumer B. Nevertheless there is an organisation, which controls the power flow and knows precisely which part of the 1 MWh in question goes from supplier A to consumer B. In Russia, this organisation is called the System Operator.

On 1st September 2006, the Wholesale Electricity and Capacity Market was launched in Russia. The transition from tariffs (government-regulated prices) to market prices was gradual; at first, only 5% of total volume was traded by market price, the remaining 95% was still paid by tariff. Step by step, the share bought and sold by market price increased while the tariff share decreased. In 2011 the Wholesale Electricity and Capacity Market of Russia was liberalised entirely and so since that year, the maximum possible volume has been traded by market prices. Why is this not 100%? Because, according to Russian legislation, the public, i.e. people living in houses and apartments, still buys electricity according to tariffs. In 2017 approximately 16% of all consumed electricity was paid by tariffs [5].

In addition to the wholesale market, the Retail Electricity Market of Russia was launched in 2012. The retail market price for consumers, excluding the public, consists of three main components:

- wholesale market price,

- price of losses in the network, where a consumer is connected (in Russia, this is paid by tariff),

- distribution company premium.

Distribution companies can only vary their premium — the first two components are out of their control. Thus, no competition is possible in the retail electricity market [1].

1.3. Capacity as a market commodity

Expenses for electricity production include two types of cost: fixed and variable. Fixed costs usually include wages, maintenance, equipment upgrades and, most importantly, investments for new power plant construction. Variable costs are mainly fuel costs [6].

If we refer back to figure 1b, we'll notice that the closer the demand is to the upper supply limit, the higher the market price. This means that suppliers are not very interested in constructing new, more efficient power plants, which might push the market price down. However, the government is terrified of cases when demand exceeds supply, because of two aspects:

1) It is a direct threat to supply security.

Cases where demand exceeds supply seem to be rather theoretical until a power plant accident occurs. An example of this happened in Russia on 17th August 2009 when Sayano-Shushenskaya power plant, the biggest power plant in the country, switched off accidentally. Special regulation methods were applied to maintain the supply. Thus, there must always be power plants available to replace any that are out of operation, even if they do not produce anything on a long-term basis. This available production is called the reserve.

2) It is the primary cause of very high market prices.

An example of this occurred on 15th December 2000 in California, when the wholesale electricity price went up to 1400 USD/MWh, while the average price the year before was around 45 USD/MWh. This occasion is well known as the California Electricity Crisis [7].

Consequently, the supplier's interests are opposed to the government's ones. Today, a compromise between these two sides is arranged through different schemes of investment return for new power plant construction and payments for the power plants in reserve.

In some countries, like the United Kingdom, USA and Russia, individual markets for electricity and capacity have been developed. For a supplier, income from the electricity market covers the variable costs and income from the capacity market covers fixed costs. In other countries, including most of Europe, the wholesale electricity market operates with a single commodity — electricity. Here, either total cost is included in the electricity price or fixed costs are paid with special capacity certificates (for example, in France). Capacity contracts and reserve payments have long-term horizons of up to several years.

The government defines both technological priorities and the amount of new power capacity to be put into operation according to the long-term economic development plan of the country. The selection of new power plant projects is performed at auction within given criteria.

In 2009, in a document known as the Renewable Energy Directive, the European Union authority set a clear goal: by 2020 about 20% of electricity will be produced by wind and solar power plants. This assumed that new renewable power plants would replace existing gas and coal thermal power plants to reduce the amount of carbon dioxide emissions. Today the share of renewable production has reached 53% in Denmark, 26% in Germany, 23% in Spain and is continually increasing for other European countries [8]. However, when electricity production is highly dependent on weather conditions, the power system becomes vulnerable: what will happen, if the wind doesn't blow during the night? For this reason, in countries with a high share of renewable production, special measures are taken to maintain the reliability of supply. These include:

- boosting transmission interconnections between different parts of the country and even different countries (Texas, California, European Union);

- building high capacity power storage systems (Australia);

- improving wind and solar power plant production forecasting (Spain);

- incentivisation for the supplier to reduce production using negative wholesale electricity prices (Germany, Scandinavia, Austria, Switzerland); negative prices lead to additional costs for suppliers, who have to pay for produced electricity.

Before 2011 in Russia, fixed costs were paid by a capacity tariff. The first capacity auction took place in 2011 and since then fixed costs have been paid by market capacity prices. The government set the following goals for the Russian capacity market [6]:

- secure a reliable power supply;

- attraction of investment in building new power plants and upgrade operating ones;

- minimise the total cost of electricity for end users.

In 2015 suppliers made 40% of total income on capacity trading. Payment is organised through a number of special contracts, government subsidies among them. Details about capacity contracts can be found in [9].

The launching of new power plants, paid for with new capacity contracts, together with lower than expected consumption increase has led to a surplus of capacity in the Russian power system. Currently, the estimated surplus is about 15 GW according to [6], and about 30 GW according to [9].

1.4. Power trade schemes

Electricity can be traded through two general schemes.

The first and most evident scheme implies the following: all suppliers make a bilateral agreement with all consumers and electricity is paid according to actual power flows in the networks. Currently, there are more than 100 suppliers and more than 240 consumers in Russia [10]. To put this scheme into operation more than 24 000 bilateral agreement would have to be made, which would be very cumbersome to negotiate, control and pay. Another disadvantage of the scheme is complete opacity: bilateral contract details can’t be openly published. The opacity makes the market price unclear, market behaviour unpredictable and, as a result, the market does not attract investors. That's why this scheme is not put into practice.

The second scheme requires a particular organisation which buys all the electricity from suppliers and sells it to consumers. In Russia, the wholesale electricity market operates under such a scheme. This organisation is referred to as the power exchange (Continental Europe, Russia) or the power pool (Scandinavia) and in Russia it is known as the Administrator of Trade System. The two main responsibilities of the power exchange are the follows:

- to perform auctions,

- to publish market statistics.

This scheme makes the electricity market more or less transparent and is widely applied all over the world.

1.5. Trade participants

1.5.1. Suppliers

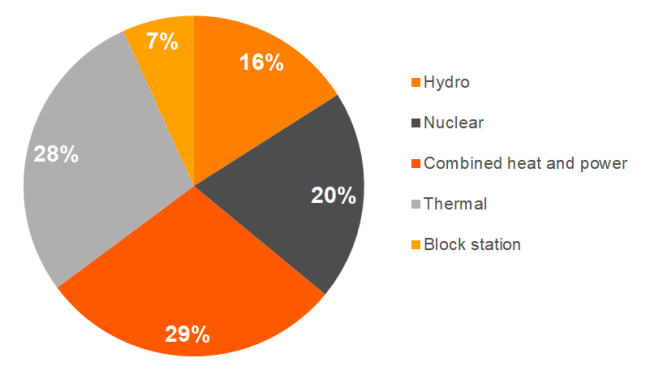

Power plants with an installed capacity of over 25 MW can become suppliers on the Wholesale Electricity Market of Russia [11]. The classification of suppliers can be made in several ways. One is to classify them according to the technology used to produce electricity. In Russia, there is a company, Rosenergoatom, which owns all ten nuclear power plants of the country. There is also Rushyrdo, which owns most of the hydropower plants. Thermal power plants belong to dozens of companies. So-called Wholesale Generation Companies own big thermal power plants, which mainly operate in condenser mode. This means that those power plants produce electricity with no heat production. Similarly, Territorial Generation Companies own, mostly, combined heat and power plants, which simultaneously generate electricity and heat as hot water or steam. The share of total electricity production for each supplier type in Russia in 2017 is shown in figure 2. Note that a block station is a small power plant which is not a wholesale electricity market participant and operates on the retail market.

Suppliers can be categorised into two big groups concerning their variable costs.

The first group includes thermal power plants, which burn fossil fuel to produce electricity. Variable costs of these power plants are within the range 300-20000 rub/MWh, which is 4-250 euro/MWh (exchange rate = 78 rub/euro, November 2018).

The second group includes nuclear, hydro, wind and solar power plants. Their variable costs are equal to zero.

1.5.2. Consumers

A consumer with an installed receiving capacity of over 20 MVA (megavolt ampere) may become the Wholesale Electricity Market of Russia participant [11].

Consumers can be divided into three groups.

The first group consists of distribution companies with the peculiar status of guarantee supplier. This unusual status is the legacy of the previous tariff system. Such companies, like Mosenergosbyt, Volgogradenergosbyt, Kaluga Distribution Company, etc., buy electricity on the wholesale market and sell it on to the retail market. Thus for end users, they are literally electricity suppliers, despite the fact they do not produce electricity. The only difference between the guarantee supplier and other distribution companies is that the guarantee supplier must accept any client who wants to buy electricity on the retail side, even if it’s not a trustworthy one. Of course, untrustworthy clients increase a guarantee supplier's risks. To compensate that additional risk a special risk hedging mechanism has been developed for the guarantee supplier in the wholesale electricity market. In 2017, in the wholesale market of Russia, approximately 60% of total electricity was bought by guarantee suppliers. The public buys electricity from local guarantee suppliers by tariff. The tariff is established by local executive authorities. For example, the 2018 Q1 tariff in Moscow city (guarantee supplier Mosenergosbyt) was 5.03 rub/kWh (set by Moscow Government), while the average wholesale market electricity price for that region was 1228 rub/MWh, which is 1.23 rub/kWh.

The second group consists of distribution companies with no special status. Such distribution companies buy electricity on the wholesale market for their clients — big consumers. For example, Rusenergosbyt buys electricity for Russian Railways, Lukoil-Service buys for Lukoil, etc.

The third group consists of end consumers. Usually, these are big plants and factories which require from dozens to hundreds of MWh to operate. For example, Novolipetsk Steel Factory, Volga Pipe Plant, Russian Aluminium, etc.

1.5.3. Others

The collection of power distribution equipment and transmission lines is called the power grid or power network. Parts of the power grid belong to grid companies. The Federal Grid Company owns high voltage lines (voltages 150-1150 kV). Territorial grid companies own medium and low voltage lines (3-110 kV). Electricity losses appear when electricity is transferred from one point of the grid to another. Losses are paid by tariff in Russia.

The import and export of electricity with Russia's neighbouring countries (Finland, Belarus, Ukraine, Georgia, China, Mongolia, etc.) is carried out by a single state-owned company, Inter RAO.

The System Operator carries out a wide range of functions:

- controls power flow in the power system;

- ensures a reliable power supply;

- maintains the balance between consumption and production of electricity;

- secures electrical grid frequency 50 Hz, etc.

Trading is carried out by the Administrator of Trade System and accounting is executed by the Financial Settlement Centre. The services of each of these are paid for by tariff.

The Market Counsel performs updates and improvements to the market rules.

Authorities — including parliament and government, the Federal Anti-Monopoly Service and the Federal Tariff Service — take part in the regulation and control of the Wholesale Electricity and Capacity Market of Russia.